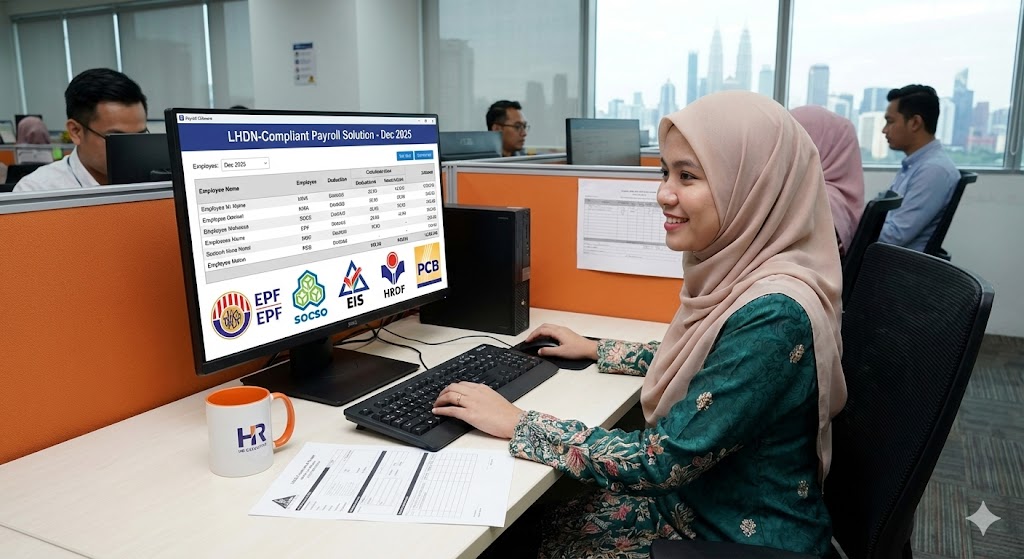

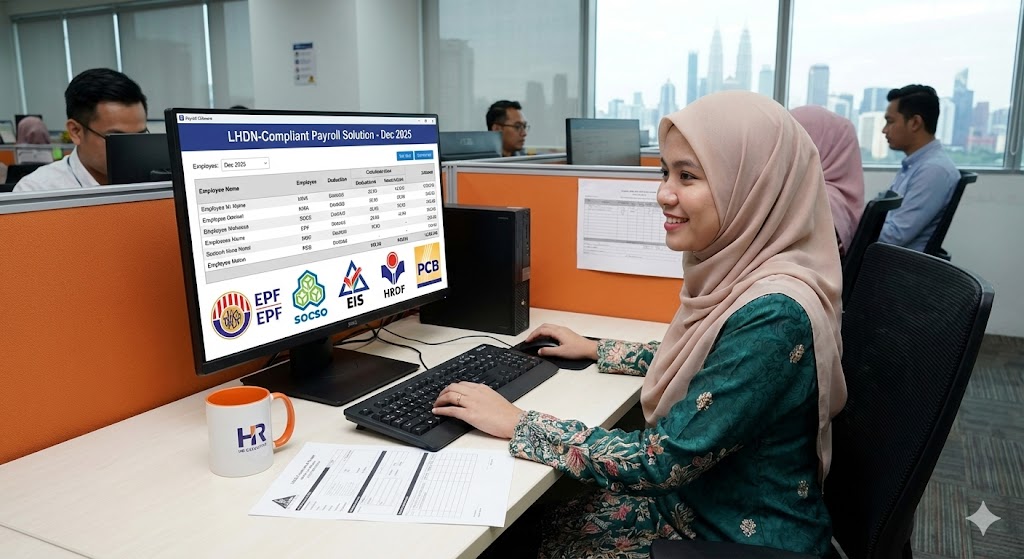

BizCloud Payroll Module

LHDN-approved Payroll Solution for Malaysian Businesses. Automates monthly tax deductions (MTD) using the Computerized Calculation Method. Fully compliant with Malaysian regulations including EPF, SOCSO, EIS, HRDF, and PCB.

LHDN-approved Payroll Solution for Malaysian Businesses. Automates monthly tax deductions (MTD) using the Computerized Calculation Method. Fully compliant with Malaysian regulations including EPF, SOCSO, EIS, HRDF, and PCB.

BizCloud HRM Payroll system enables authorized personnel to create accurate payroll computations compliant with Malaysian Labour Law, including proper calculation of unpaid leave deductions and statutory contributions.

Computerized Calculation Method for MTD compliance

Automatic EPF, SOCSO, EIS, PCB deductions

Automated year-end EA form creation

Automatic leave balance calculations and deductions

Claim processing directly in payroll

Regular statutory requirement updates

Our system automatically calculates all statutory contributions in compliance with Malaysian Labour Law:

Easy submission process for all statutory requirements:

Our payroll specialists can help you implement the system in just 1-3 weeks with full compliance to Malaysian statutory requirements.

Use just the payroll module without other HR components

Full integration with other modules

Define income & deductions

Attendance & leave integration

Automatic statutory deductions

Generate payslips

Process payments & filings

Menu > Employee > Employee PayrollUse the provided template to upload: Employee income and Deductions. Upload via Step 3: Import Income or Import Deduction on payroll page.

Payroll integrates with approved leave, claims, and attendance for auto-calculation:

Set at Admin > Company Info > HRM Tab: Enable EA rounding. Define payroll days: calendar or 26-day basis.

Compliant with Malaysian Labour Law requirements

Menu > Payroll > Payroll ListEmployees go to: Menu > Payroll > Personal Payroll

View/download their monthly payslips through:

If there are any alterations to the data, payroll personnel can click the Recalc button to re-calculate payroll for that employee based on the changes.

Go to: Menu > HR > Payroll Setting > Payroll Setting

Our payroll specialists can help you set up compliant payslips tailored to your company's requirements.

Menu > HR > Payroll Setting > Income ListMenu > HR > Payroll Setting > Tax/Deduction ListNavigate to: Menu > Payroll > Pay Period List

View payrolls by month or period with:

Go to: Menu > Payroll > Payroll List

Filter and export payroll records:

View by individual via Employee > Employee Payroll

Complete historical data with:

Our payroll specialists can help you implement the system in just 2-3 business days. Fully compliant with all Malaysian statutory requirements including LHDN, EPF, SOCSO, and EIS regulations.